Table of Contents

Getting Started

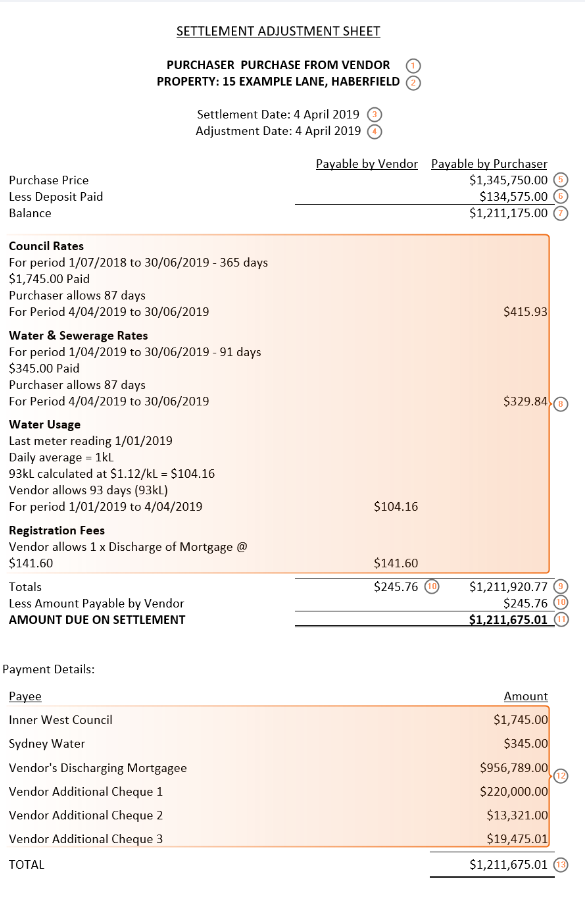

Learn more about Settlement Financials.

Generate Settlement Adjustment Sheet

1. Select Precedent from the Matter Action Bar.

2. Select either:

- Conveyancing Sale category and then the Settlement folder; or

- Conveyancing Purchase category and then the Pre Settlement folder.

3. Double-click Settlement Adjustment Sheet to open the precedent in Word.

Where the data comes from

| 1. | Party surnames | Purchaser's surname(s) obtained from Purchaser contact card(s) and Vendor's surname(s) obtained from Vendor contact card(s) |

| 2. | Property Address | Property Details |

| 3. | Settlement Date | Automatically populates from Conveyancing Details but can be manually overwritten |

| 4. | Adjustment Date | Automatically populates from Conveyancing Details |

| 5. | Purchase Price | Conveyancing Details |

| 6. | Deposit Paid | Conveyancing Details |

| 7. | Balance | Automatic calculation of Purchase Price less Paid Deposit Amount |

| 8. | Adjustment Items | Settlement Financials |

| 9. | Totals | Calculation of all Purchaser Adjustments plus Balance |

| 10. | Totals | Calculation of all Vendor Adjustments |

| 11. | Amount Due on Settlement | Calculation of Total (9) minus (10) |

| 12. | Payment Details | Settlement Financials > Payment tab > Payment Direction All Vendor selected payments. To remove payments, they must be removed from Settlement Financials. Any greyed out payments need to be updated on the Adjustment Item. |

| 13. | Total | Settlement Financials > Vendor Payments Total Amount |

Handy Hints

- To remove an item from Settlement Financials hover over the entry with your mouse and click the red x to delete.

- To remove payments, they must be removed in Settlement Financials on the Payment tab. Any greyed out payments need to be updated on the Adjustment Item where they were created. To remove a greyed out payment, change the payment amount to '0' on the Adjustment.

- If the deposit does not display, ensure it has been selected as paid in Conveyancing Details.

- If GST applies to the purchase price select the GST Type in Conveyancing Details and complete the GST Amount.

- If GST applies to adjustments, check Plus GST on each adjustment in Settlement Financials.

- If the funds have been overdrawn, a red warning message will appear advising that Vendor payments are overdrawn. To resolve, return to the Payments tab and ensure that the calculations are accurate.

- If additional funds are required to settle, a blue warning message will appear advising that Payment details are yet to be provided. To resolve, return to the Payments tab and ensure that the calculations are accurate.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article